LTCi Awareness Month approaches, as need for care is likely for many

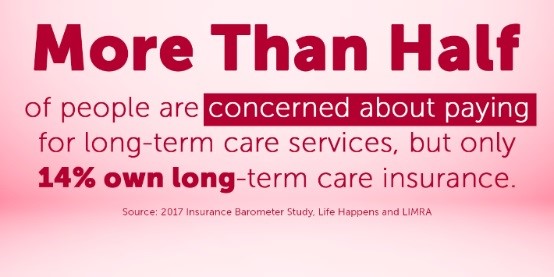

The need for LTCi to pay for long-term care is becoming more critical every day. While the U.S. Department of Health and Human Services estimates that 70% of people turning 65 today will require long-term care at some point, only 17% of respondents to the Insurance Barometer Study conducted by Life Happens and LIMRA say they have individual LTC coverage.

During November, which is Long-Term Care Insurance Awareness Month, financial professionals will share the message with their clients and prospects that getting LTCi can help cover the cost of care when that care is needed the most.

Helping clients and prospects obtain LTCi

So what can agents and advisors do to motivate their clients and prospects to acquire the LTCi they need during LTCi Awareness Month – and long after the campaign is over?

There are the easy-to-motivate prospects and clients, explained Matt Dean, vice president, MarketPlace Group, LTCI Partners, LLC. These prospects have lived through a care event and understand the consequences and how insurance benefits lessen the financial and emotional strain on everyone. Then there are the harder-to-motivate prospects – everyone else.

“The biggest mistake I see in attempts to motivate these clients is the use of statistics,” Dean said. “Dump the statistics. We would have endless interest if statistics worked. Motivating through probability doesn’t work. Motivating through ‘impact’ works.

“It doesn’t matter the probability if the consequence is big enough,” he said, adding, “It’s why we buy life insurance, even though an untimely death is unlikely. Help them consider the impact a care event has on the people they have invited into their life. This meaningful conversation helps people internalize both the financial and emotional consequences that a care event has on everyone around them.”

Dean offered a suggestion on how agents can start the conversation:

“This topic, left ignored, can disrupt all that you envision for yourself and for your loved ones: your access to quality care in a setting you prefer, the future income for a spouse, and any legacy plans for children or charity. You see, this isn’t just about you. It’s about your spouse, your children, and others impacted by your need for care. The good news is we can review your income and assets and determine if insurance can play a role in minimizing the significant disruption caused by the need for care.”

Ultimately this leads to a meaningful and engaged discussion with the prospect who is now more inclined to act, he added. This is much better than a client who was told, “70% chance you’ll need care.”

Overcoming objections

Even after motivating prospects to act, advisors are sometimes met with objections from them, such as the price of the LTCi policy is too high. Ideally, value and affordability were established with the prospect before he was presented with a quote, said Dean, but despite the advisors’ best efforts, price may be an objection.

The keys to overcoming this objection aren’t through statements of fact and statistics, but through meaningful dialogue about the consequences of needing care, said Dean. He added: “I don’t like to ask clients, “So what are you willing to pay?” If you don’t see the value in something, what price are you willing to pay for it? Price is an issue in the absence of value; therefore, focus on building value and not on chasing an ever-lower quote.”

The conversation with the prospect should sound something like this, advised Dean: “Insurance costs reflect risk, and these premiums reflect the significant financial consequences to you and your family of needing care. Let’s talk about those consequences and then look at the many ways we can balance meaningful benefits that fit your budget.”

The “use it or lose it” objection some prospects have to buying LTCi is another one that is best dealt with pre-emptively, Dean added. The advisor’s conversation prior to the quote should measure costs by the consequences that a care event will have on them and their family.

He said that he tells clients: “I am not suggesting you will need this, and we all hope we never will. As we discussed, the impact of needing care is significant to you and your loved ones, and if it does happen, do you agree that the stakes are high enough and worthy of a plan to minimize that impact?”

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at amseka@INNfeedback.com.