The Covid-19 virus entered the United States as early as December and created consternation by mid-March. We did a poorer job by far in responding to this deadly virus than any developed country. We are still lacking robust testing and contact tracing, and many Americans refuse to wear masks. By the time you read this, 500,000 Americans will have died due to Covid-19.

We faced a second wave of Covid-19 during the winter. Even if a vaccine is proven to be effective, it could be many months before most Americans can be vaccinated, even if they want to be. We will defeat this virus, but it may take a while longer.

The effects of the virus on us have been huge and have caused panic and uncertainty. We have had to shelter in place. In addition, we mentally have frozen in place. In our efforts in trying to cope with the present threat of this virus, we tend not to think of our future. Most of our financial planning, including long-term care planning, has been effectively placed on hold.

Now that a few months have passed we have learned a great deal, and we still don’t know a great deal. But maybe enough of the fog has cleared that we can predict the future with at least some modest degree of accuracy. This article will attempt to foresee the future of long-term care solutions as reflected in the eyes of government, insurance carriers and prospects. We will only know years from now how accurate these predictions are.

GOVERNMENT:

Enormous deficit spending and lower tax receipts will create major challenges for local, state and federal governments. They will have to cut back and eliminate many programs that its citizens want them to provide. It is likely that we will be in a very low interest rate environment for many years. Government debt will become dangerously high. The Federal Reserve Board has reduced interest rates to almost zero in order to stimulate borrowing, and Congress has responded. The Federal Reserve Board has many levers to control the rate of inflation, and it will utilize all of them to keep interest rates low and to stimulate the economy.

As President, Biden will be compelled to raise income taxes for the very rich in order to reduce deficit spending. Even so, he will initially be limited in proposing spending for social causes, just because the money isn’t there. His actions may be further limited if the Republicans still control the Senate.

He campaigned on health care as a major issue and will advocate a government health care option, not Medicare for all. It’s questionable whether such an option would include long-term care benefits, due to the high cost of coverage. My sense is that if long-term care benefits become a part of a government health care plan, it will either be a minimal benefit and/or it will be a rider and not be a part of the base policy.

Health care is such a complex subject that it will be fiercely debated and it could take years before a new government plan could become law. Such a law would have to overcome the objections of insurance carriers, medical providers, hospitals and the device makers. The public would have to overwhelmingly support such a plan for it to gain traction and succeed. The Affordable Care Act took years to enact, and I foresee similar conditions now.

One major wild card here. The Republican Party will eventually have to reinvent itself in the face of increasingly unfavorable demographics. In this process, it could reject the extreme right philosophy that it has adopted under President Trump and move towards the political center. That could dramatically alter the future and make social changes more likely.

INSURANCE COMPANIES:

Despite the increasing need, sales of traditional long-term care insurance policies have been declining for years, some 85 % down from the early 2000’s, and this product is now recognized by insurance carriers as an unprofitable loser. This is still true in spite of the fact the premiums are up to three times what they were decades ago. With one or two exceptions, the insurance carriers have lost all economies of scale, and at today’s sales levels, they can’t make much money if any regardless of what they charge.

In addition, with the very low interest rate environment forthcoming, their interest rate assumptions, already low, will still be higher than projected future income from safe investments. They will either have to make riskier investments or seek further rate increases, even on current products. There may also be more pressure on their reserves.

We still don’t know the long-term effects from Covid-19 on people’s health, especially the health of the older population. What are the implications for one’s kidneys, livers, lungs and heart? Will insurance carriers have to factor in unknown potential claims resulting from the long-term effects of this disease?

These factors have led to the insurance carriers being for more comfortable selling hybrid life/long-term care and annuity/long-term care products. There has also been a large growth of life insurance policies with accelerated benefit riders, usually for chronic illness. The distinction of benefits between these chronic illness riders and traditional long-term care insurance has become very small. Now some 40 % of life insurance sales include riders which cover long-term care costs.

The risks in life insurance and annuities are far better known than the risks associated with traditional long-term care products. These riders have become the main vehicle to protect people against the largest threat to their retirement.

CONSUMERS:

The initial reaction of Americans to Covid-19 was to become, scared and threatened, and feel unsafe. We retreated to our homes and ceased many of our normal activities. We also had to learn to perform many routine functions differently and this required a significant mental adjustment. Now was not a time to think about the future but to worry about the present and make sure that our changed lifestyle would provide for us the best chance of surviving the pandemic.

It’s obvious that the pandemic has resulted in horrible publicity for nursing homes, where many patients have become sick and died. It’s even more difficult now to envision anyone interested in nursing home insurance, or even long-term care insurance with its history of caregiving in nursing homes and assisted living facilities. Almost everyone will want to be cared for at home instead. It’s actually a small mental difference from “sheltering in place” to “nursing care in place.” Life insurance products which cover long-term care costs provide less of this nursing home stigma and will be more readily accepted.

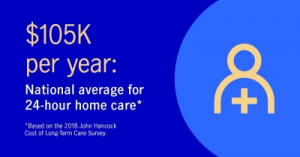

This nursing home stigma may require a change in long-term care product marketing to become something like “home caregiving insurance,” rather than long-term care insurance, even if it includes benefits for care in nursing homes and assisted living facilities. There will have to be a large increase in both the number of caregivers and in their compensation due to the rejection of nursing homes and the rising demand of folks to stay at home.

Now that a few months have passed, and the methods to fight this virus have become better understood, we have become less fearful and are beginning to resume some of our normal activities. We can even envision a time when we will be able to adjust to whatever the new normal is and go on with our lives. This may take a few months longer, but it will happen eventually.

This could cause a long-range change in our thinking from the immediate crisis to a longer view of our needs. At that time, we will consider protection to be the basic need that it has always been. Protection can take many forms, but we will mostly want to protect our families against loss of income due to death and expense due to bad health.

Therefore, I envision a slow but steady growth of hybrid/life long-term care insurance and life insurance with long-term care riders or chronic illness riders. This could take up to ten years to occur, but many will recognize the need for this protection and take action to protect their families.

Our current system of health care is unsustainable and we all know it. There will continue to be a great deal of talk and no action until a consensus emerges. I foresee a completely different system in place by 2030 with some sort of health care for all. It’s going to be interesting to see what form it takes. Stay tuned.

By Louis H. Brownstone

It’s important to consider care options while a person is healthy. That’s when the best rates and options are available and families are in much better emotional shape to discuss long term care-related planning. The simple truth is that during a crisis, situations can quickly escalate and cause tension or introduce issues that could have otherwise been avoided.

It’s important to consider care options while a person is healthy. That’s when the best rates and options are available and families are in much better emotional shape to discuss long term care-related planning. The simple truth is that during a crisis, situations can quickly escalate and cause tension or introduce issues that could have otherwise been avoided.